- Category :Finance

There are some financial ratios that are regarded as liquidity ratios and among these ratios, the current ratio and quick ratio have their own importance. This article discusses the difference between the two while highlighting the importance of both ratios, current ratio and acid test ratio or quick ratio.

There are several ratios that are to be categorized in accordance with the financial activities of a business entity. One of them is current ratio. Good current ratio indicates short term solvency position of a business firm. The calculation of current ratio includes current assets and current liabilities. Current assets can be defined as being those that will be converted in to cash in twelve months period. They are: Cash, Receivables, inventories, marketable securities and prepayments.

Current liabilities are those that are to be settled in twelve months period. Current liabilities are: Accounts payable, unearned revenues and wages payable etc.

The formula for current ratio is: Current Assets / Current Liabilities.

The current ratio is calculated by dividing current assets by current liabilities of a business entity. Current ratio is one of the most powerful and effective tool of financial analysis. It is used to measure the short term solvency of a business entity. A ratio of greater than one obtained through current ratio calculation indicates the business entity has more current assets than current liabilities. It is generally accepted that a current ratio of 2 to 1 or greater is satisfactory. It shows that the business entity has comparatively more current assets than current liabilities.

The importance of current ratio emerges when there is a need to evaluate the short term solvency of a business entity. In this way the ratio having been calculated on the basis of current assets and current liabilities is regarded as a standard of comparison. If the resultant figure is 2 or more it is a good indication that the short terms solvency position of a business entity is satisfactory.

The difference between the current ratio and the acid test ratio, which is also called as quick ratio, is that the current ratio uses the total amount of all the current assets, whereas the acid test ratio or quick ratio uses these assets: Cash and Cash equivalents, short term marketable securities and accounts receivables. It must be noted that though inventory and prepaid expenses are to be included in current assets, but the acid test ratio or quick ratio does not use them, because the quick ratio, as the name suggests, uses the above mentioned assets which are considered as quick assets.

Quick ratio is calculated using the formula: Cash + Marketable Securities + Receivables/Current Liabilities

It can also be calculated with this formula: Current Assets - Inventory - Prepayments / Current Liabilities

Thus, the current ratio can be used to determine the margin of safety for a business entity, whereas the Quick ratio can be used to measure the liquidity of a business by matching its cash and near cash current assets with its total liabilities. It helps to determine whether a business would be able to pay off all its debts by using its most liquid assets.

Written by:

K. A. Fareed (Fareed Siddiqui)

Writer, Trainer, Author, Software Developer

BBA, MBA-Finance, MPhil-Financial Management, (PhD-Management)

MA-English, MPhil-English

Level 1 - Leadership and Management ILM – UK

Pursuing CMA-USA

Individual Member of Institute of Management Consultants of India

Related Articles

Accounting And Finance - The Difference Between Account

Accounting is the process of recording, classifying and summarizing the information that is of financial character. It’s a systematic and scientific recording system.

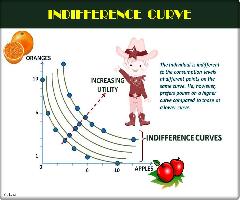

What Is Ordinal Utility & The Concept Of Indifference C

All economic activities including the most complex ones are finally aimed at consumption. However, to understand the kind of consumption that may be preferred by an individual, the concept of utility and indifference curve are extremely helpful.

The Difference Between Current And Capital Expenses

If anybody ever tells you that accounting is too simple, just ask him to tell you the difference between capital and current expenditure. In its full complexity, the question is and will always remain worth an argument.